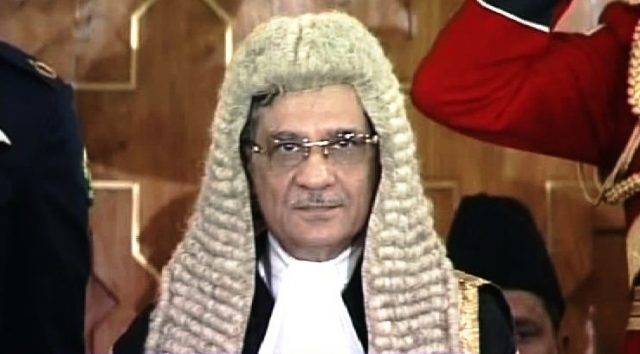

ISLAMABAD - Chief Justice Mian Saqib Nisar, while hearing Hanif Abbasi’s petition against the Pakistan Tehreek-e-Insaf (PTI) leader Jahangir Tareen, on Wednesday remarked that cases pending before other fora would not deter Supreme Court from interpretation.

A three-member bench, headed by the chief justice, is hearing the PML-N leader’s petition against Tareen for having an offshore company, writing off loan and misdeclaration about agri income before the Election Commission of Pakistan (ECP).

Sikandar Bashir, representing Tareen, said the reference and the CPLA regarding agriculture tax was pending before the Lahore High Court (LHC) and the Supreme Court. He argued the appeals against their decision would ultimately come before the apex court.

The lawyer contended that due process of law was the right of his client.

He asked the bench that the high court was examining six samples of the lease agreements, therefore the petitioner should contest that issue before those fora, and requested the bench to decline the petitioner’s request.

The chief justice said that a sub-judice matter before other fora would not deter the apex court from interpretation. “We have to interpret the law, while the matter was before the LHC and the Supreme Court about jurisdiction of the revenue authorities,” he said.

The Supreme Court said the allegation was that Jahangir Tareen concealed agriculture income from leased land in his nomination papers.

The chief justice said that Justice Asif Saeed Khan Khosa stated that even if the matter was pending before other fora the power of the Supreme Court could not be circumvented.

“We can withdraw the reference pending in the LHC,” the CJP added.

Justice Nisar said, “You have declared the agri-income from your own land but it is alleged that you concealed income from the lease land.”

Justice Umar Atta Bandial asked the Bashir to show reference, which you have filed in the high court.

Basher instead of replying to the judge’s query said that till now the court had not framed questions. It had examined six samples of lease agreements.

Bashir said the court could not arrogate the authority of the tax auditor and examine tax history.

He said that his client’s case would be prejudiced, if any finding came from the apex court in that hearing under Article 184(3) of Constitution.

The chief justice inquired whatever the declaration his client had made before the ECP were in accordance with the law. Justice Bandial simplified the matter by saying; “We have to see the issue of disqualification, which is on the basis of declaration given on oath before the ECP.”

The judge asked Bashir that your contention was that whatever the allegation of mis-declaration was against Tareen it was to be established.

Bashir argued that there was no mis-declaration as alleged by the petitioner.

“Yes, I [speaking on behalf of Tareen] did mis-declare but that was with the rider effect,” he said.

He informed agri-income declared in the income tax return was part of Tareen’s nomination form.

“Jahangir Tareen made full disclosure in the nomination papers,” Bashir said.

Justice Bandial asked did disclosure of agri-income in the nomination paper included income from the leased land.

The counsel contended that in the nomination form the agri-income was from land owned, adding complications in the form was not his fault.

He said that that apex court bench had already made it clear that they would not go into the nitty-gritties and calculation of tax was not their job.

The chief justice said that in Entry 14 of your nomination papers you have explained about the land ownership that you have 507 acres and how much agri-income was and how much agri-tax paid.

The CJP asked him that his client declared income from leased land before the Punjab tax authorities and thought that he was not suppose to declare it before the ECP. “So this way you think there is no mis-declaration,” he added.

Bashir contended that Entry 14 in the nomination paper was ambiguous, adding the disclosures about both the lands (leased and owned) were made before the relevant authorities at the same time.

“Jahangir Tareen could not be disqualified under Section 12(2) of ROPA. As no show cause notice has been issued to him and there is also no complaint against him,” he said.

Justice Bandial remarked that the allegation against his client was that he had laundered money through tax by showing it as inflated agri-income tax.

The income from leased land has not been established. “We are not bothered whether you paid full tax [or not].”

Justice Faisal asked the counsel that you wanted to say that dishonesty in reporting in the nomination papers was to be established.

Bashir argued that agri-income assessment deadline was two years after that the authorities could not issue notice as it had attained finality.

The assessment could not be reopened in the proceedings of Article 184(3) of Constitution.

The chief justice said that still they did not know what he wanted to say.

Bashir said: “I [Jahangir] made full and correct disclosure as required by the Entry 14 of the nomination paper.”

Each of the entries made in Entry 14 are factually correct as of the date of filing of the nomination paper, he said.

Entry 14 requires the disclosure in respect of agri-income tax actually paid in the preceding three years, Bashir said. He further stated that Entry 14 required the details of agri-income tax paid on land, which was owned by Jahangir Tareen.

The chief justice said that if that was the matter then it ended here, adding; “We have to [assess] whether the holding will be taken in broad sense or the ownership.”

He directed the petitioner and Tareen’s counsel to apprise the court about the law in that regard.

Bashir said Tareen should be given room as at the time of filling of the nomination paper it was the understanding of his client that land-holding means the land owned therefore he had shown the agri-income from the land owned.

The chief justice said that if this room was given to him then everyone will ask for the same.

Justice Bandial pointed out to the counsel that in one place of his statement he had sought exemption on the lease land.

Earlier, Justice Faisal said you have to pay the tax under Section 3(4) of the Punjab Agriculture Income Tax Act 1997 i.e. to pay tax on the agri-income from the leased land.

Bashir said if my leasor is also paying the tax on his agri-income then why he should pay the agri-income tax as well on the leased land.

Justice Faisal said the leasee had to pay the income tax in accordance with the law.

The case was adjourned till Thursday.