karachi

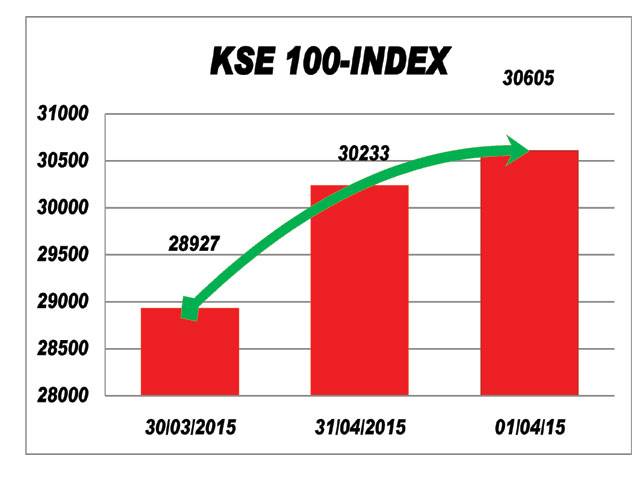

Karachi Stock Exchange Wednesday rallied by 1.2pc adding 371 points to close at 30,605 points level. Institutional support helped KSE-100 gained 5.8pc in last 2 sessions after a sharp fall of 3.4pc on Monday, recording week to date gain at 2.3pc. The 11-year low CPI of 2.49pc also strengthened investors’ sentiments.

Total volumes traded declined by 6pc to 245m shares, while value improved by 33pc to Rs15b/ $152m.

Institutional support in cement and banking sectors was seen. MLCF closed at its 5pc upper limit, whereas Lucky and DGKC were up by 4pc and 1.5pc respectively. Leading banks MCB, NBP, HBL and HMB closed at their 5pc upper limit.

The volatility witnessed in the market which rallied by 717 points after an initial low of 210 points and eventually ended up by 371 points, substantially lower than its mid-day high. In general, investors expressed a bullish momentum largely due to the positive expectation of CPI numbers which clocked in at 2.49pc, beating the industry expectation of 2.7pc. This creates a rationale for a further discount rate cut with leveraged scripts being its potential beneficiaries. Cements rallied as MLCF, CHCC and FECTC all hit their upper circuit. In the second half of the market, profit-taking was witnessed as the market shed approximately 300 points, stated analyst Arhum Ghous at JS Global.

Stocks closed bullish on speculations ahead of quarter end results due next week, market watchers said.

Activity was led by cement, fertilizer and banking stocks on strong valuations. Revision in local petroleum prices and improving economic indicators played a catalyst role in bullish activity at KSE despite late session pressure on falling global commodities prices.

Wednesday, April 17, 2024

KSE adds 371pts on institutional support

Pride and hype as F1 roars back to China after Covid absence

10:36 PM | April 16, 2024

No let-up in Karachi street crime incidents

10:35 PM | April 16, 2024

Stock market today: Most of Wall Street weakens again as Treasury yields rise more

10:34 PM | April 16, 2024

Muslim K-popstar Daud Kim buys land to build mosque in South Korea

10:33 PM | April 16, 2024

Punjab Stadium unavailability derails National Challenge Cup 2023 Final Round

10:28 PM | April 16, 2024

Political Reconciliation

April 16, 2024

Pricing Pressures

April 16, 2024

Western Hypocrisy

April 16, 2024

Policing Reforms

April 15, 2024

Storm Safety

April 15, 2024

Democratic harmony

April 16, 2024

Digital dilemma

April 16, 2024

Classroom crisis

April 16, 2024

Bridging gaps

April 16, 2024

Suicide awareness

April 15, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024