Karachi - With a view to align the cost of production of various farming activities with inflationary pressures and current market practices, the State Bank of Pakistan has revised the Report on Indicative Credit Limits & List of Eligible Items for Agri Financing.

According to SBP, the production financing limits have been revised for major and minor crops, orchards and forestry.

Under major corps, financing limits per acre for rice, wheat, cotton and sugarcane have been increased to Rs 34,000, Rs 29,000, Rs 39,000 and Rs 53,000 respectively from existing limits of Rs 19,000, Rs 16,000, Rs 21,000 and Rs 30,000 fixed in 2008.

The report provides a yardstick for banks to assess the credit needs of different groups of farmers’ vis-à-vis their activities.

Banks extensively use the report for reporting financing statistics to SBP as per the list of eligible items. The provincial planning departments use the methodology of the report to determine the farm and non-farm sector financing and credit requirements.

The revised report includes the parameters for segmentation of borrowers based on land holdings and average requirements of seed, fertilizers and pesticides have also been embedded in the revised report to facilitate provincial planning departments in computing financial and credit requirements of respective provinces for farm sector activities.

An exhaustive list of activities and purposes segregated for farm and non-farm sector has also been annexed to the Report.

The revised limits for per acre cost of production are indicative and banks can adjust these based on the actual credit requirements of farmers, market conditions, and prevailing prices of farm inputs at respective place while sanctioning the loan.

The Report has been revised in consultation with Pakistan Agriculture Research Council, provincial government including AJK, agricultural universities, agri. lending banks and farmers’ representatives.

The revised report and enhanced indicative per acre credit limits are expected to facilitate farmers in getting adequate loans for growing their farms and forestry besides facilitating banks and provincial governments to estimate actual credit requirements of the farmers.

Friday, April 19, 2024

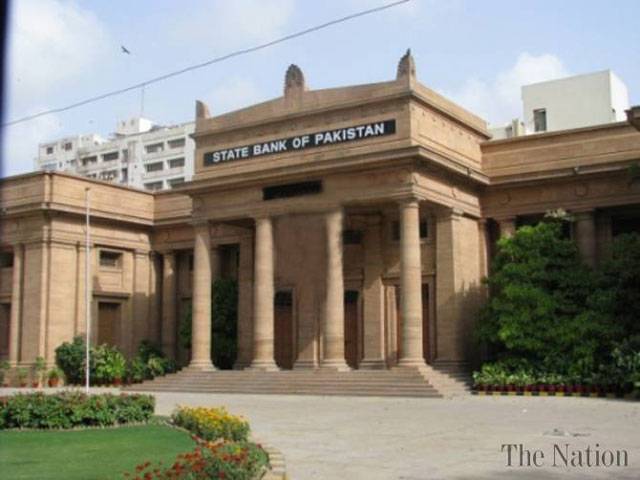

SBP revises production financing limits for agri sector

Caption: SBP revises production financing limits for agri sector

SC suspends ECP’s re-polling order in PP-51

April 19, 2024

Court approves plea bargain of Parvez Elahi’s co-accused

April 19, 2024

Zardari creates another parliamentary record

April 19, 2024

KP politicians, civil society laud President’s address

April 19, 2024

A Tense Neighbourhood

April 19, 2024

Dubai Underwater

April 19, 2024

X Debate Continues

April 19, 2024

Hepatitis Challenge

April 18, 2024

IMF Predictions

April 18, 2024

Kite tragedy

April 19, 2024

Discipline dilemma

April 19, 2024

Urgent plea

April 19, 2024

Justice denied

April 18, 2024

AI dilemmas unveiled

April 18, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024