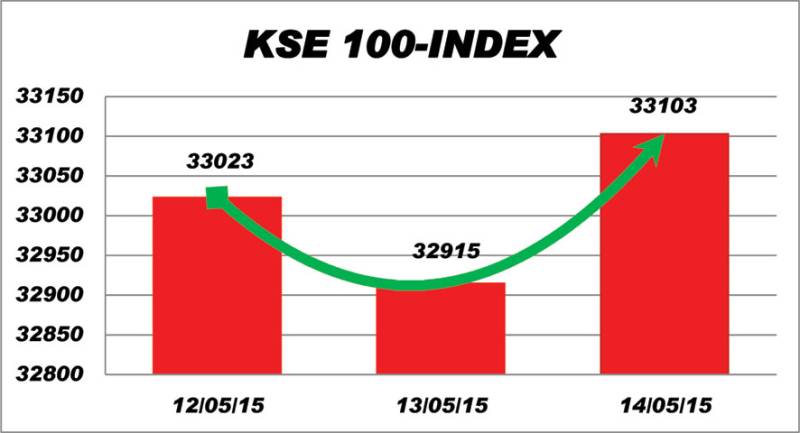

Karachi - Stocks on Thursday closed bullish led by selected scrips across the board on strong valuations, KSE-100 index rose by 188 points or 0.57pc to close to 33,103.73 points level.

After Wednesday’s unfortunate incident in Karachi that led to the death of several civilians, a day of mourning was declared in the metropolitan with major business centers closed in observance. Thus, market saw lackluster volumes of 200m shares. Volatility was witnessed in the day’s trade as early bullish momentum leading the market to rose 310 points proved to be short-lived and the market corrected itself to close at 33,103 points, up marginally by 0.6pc.

In the automobile sector, HCAR announced its financial result posting an EPS of Rs22.15 and a cash dividend of Rs5/share. The stock witnessed pressure, ending at Rs238.33, down by 3.2pc. Cement sector rallied on the back of expectations of a discount rate cut in the upcoming monetary policy as DGKC, FCCL, MLCF, LPCL and PIOC ended 1.1pc, 2.5pc, 2.1pc, 1.9pc and 2pc higher respectively.

However, expectations of a discount rate cut resulted in a mixed sentiment in the banking sector as most banking scripts still remain undervalued. BAHL, HBL, MCB ended 0.1pc, 0.9pc, and 0.7pc lower while BOP, UBL and NBP ended 3.1pc, 1.2pc and 0.9pc higher respectively, commented analyst Umair Hasan.

In expectations of monetary easing in the upcoming monetary policy KSE-100 index rose with increasing volumes. Declining T-Bill yields increased hope that the benchmark interest rate will further decline from current 8pc. HCAR declined by 3pc after announcing lower than expectations full year result. It also announced Rs.5/ cash dividend with EPS Rs.22.15, observed Samar Iqbal at brokerage house Topline.

Traded volumes of 213m shares increased by 38pc from yesterday changed hands, while value also rose by 17pc to Rs.9.8b/$98m. Analyst Ahsan Mehanti stated higher crude oil prices, Govt. accord with IMF for $506m tranche release, favourable OMCs and auto sales data for Jul-April’15 and easing political uncertainty played a catalyst role in bullish activity at KSE.

Thursday, April 18, 2024

KSE gains 188 points on easing political uncertainty

Tobacco usage declines after decision on high taxes

April 18, 2024

Enemies of Pakistan are unable to digest investment in the country: Ataullah Tarar

1:29 PM | April 18, 2024

IHC restores Bushra Bibi's appeal for shifting to Adiala Jail from Bani Gala

1:24 PM | April 18, 2024

Hepatitis Challenge

April 18, 2024

IMF Predictions

April 18, 2024

Wheat War

April 18, 2024

Rail Revival

April 17, 2024

Addressing Climate Change

April 17, 2024

Justice denied

April 18, 2024

AI dilemmas unveiled

April 18, 2024

Tax tangle

April 18, 2024

Workforce inequality

April 17, 2024

New partnerships

April 17, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024