KARACHI - Institutional profit taking was witnessed at KSE Wednesday on uncertainty over federal budget due next week and dismal fertilizer sales data for April 2014.

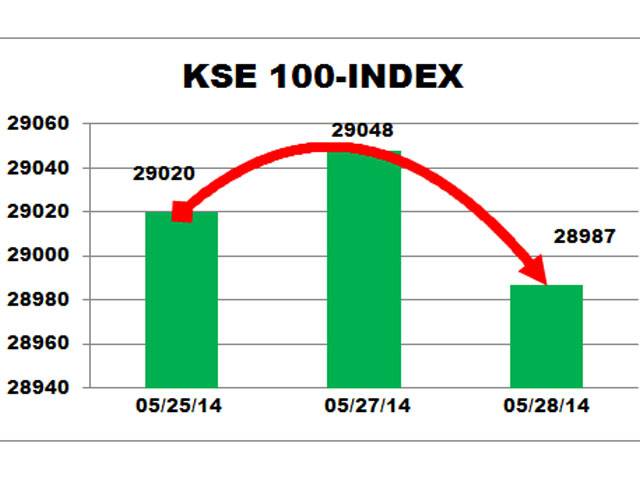

The benchmark KSE 100-share index shed 60.89 points or 0.21 per cent to end the day at 28987.32 points as compared to 29048.21 points of the previous day. Analyst said trade was led by second and third tier stocks with limited foreign interest amid prevailing pre- budget uncertainty. Uncertainty remained in banking and cement sector on expected rise in taxes despite hopes for positive outcome of bilateral talks with India expected next month. KSE allshare-index lost 53.16 points or 0.25 per cent to close the day at 21424.37 points, KSE 30-index misplaced by 109.27 points or 0.55 per cent to stop the day at 19786.97 points while KMI 30-index went down by 124.25 points or 0.27 per cent to conclude the session at 45935.06 points.

Samar Iqbal, equity expert at Topline Securities, said profit taking in heavy weights OGDC, PSO and POL pushed benchmark index below 29,000-mark. Investors’ participation increased with 34% higher volumes to 220 million shares (value rose by 17% to Rs9b after 18 trading sessions).

Trading took place in 382 companies where 177 closed in positive and 174 in negative while the values of 31 stocks remained intact. Highest decreased was reflected in the price of Nestle Pak, off by Rs 130 to Rs 7970, followed by Sanofi-Aventis, down by Rs 38.50 to Rs 911. Bata (Pak) and Fazal Textile were the top price gainers of the day, increased by Rs 40.81 to Rs 3705.56 and Rs 32.91 to Rs 691.27. KEL remained most active scrip with 50.769 million shares, gained Re 0.42 to Rs 8.85. It was followed by Pak Int Bulk (R) with 25.070 million shares, up by Rs 1.51 to Rs 9.58, Lafarge Pak with 13.600 million shares, off by Re 0.02 to Rs 14.48, JS Co with 7.430 million shares, grew by Re 0.11 to Rs 11.55 and Pak Elektron Ltd with 7.247 million shares, added Rs 1.11 to Rs 26.77.

Friday, April 19, 2024

Pre-budget uncertainty pushes KSE index below 29,000

Caption: Pre-budget uncertainty pushes KSE index below 29,000

Minister reviews naan, roti prices

April 19, 2024

ETPB land worth Rs 40b retrieved so far

April 19, 2024

Lahore revamping plan to complete by June 30

April 19, 2024

CCPO reviews security for by-elections, NZ cricket matches

April 19, 2024

A Tense Neighbourhood

April 19, 2024

Dubai Underwater

April 19, 2024

X Debate Continues

April 19, 2024

Hepatitis Challenge

April 18, 2024

IMF Predictions

April 18, 2024

Kite tragedy

April 19, 2024

Discipline dilemma

April 19, 2024

Urgent plea

April 19, 2024

Justice denied

April 18, 2024

AI dilemmas unveiled

April 18, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024