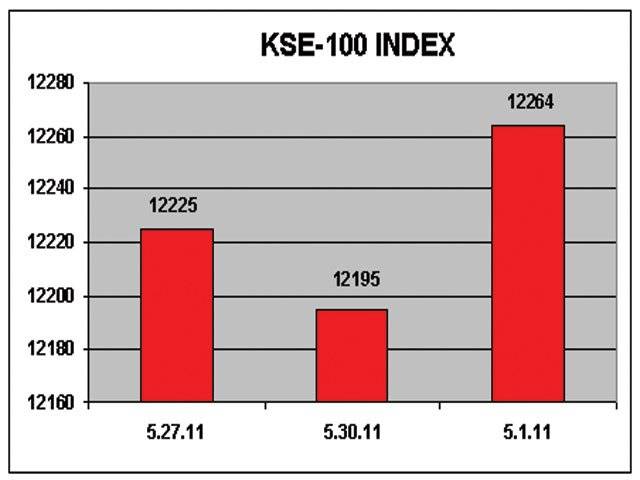

OUR STAFF REPORTER KARACHI - Bullish activity witnessed on Wednesday at Karachi Stock Exchange ahead of upcoming federal budget 2011-12 announcement this week. The Karachi Stock Exchanges 100-share index managed to close at 12,264.06 points, up 140.91 points or 1.16 per cent on market turnover of 118.31 million shares. The KSE market capitalisation amounted to Rs3, 256.91 billion or $37.91 billion while trading value was recorded at Rs4.75 billion or $55.31 million respectively. The KSE-30 index ended higher 11,890.10 points with the gains of 127.34 points or 1.08 per cent. The KSE future volume recorded at 3.47 million shares and it value was at Rs461.05 million shares with 7.48 per cent spread rate. Pre-budget rally was lead by oil sector scrips after US Brent crude crossed $116 a barrel and expectation loom over positive federal budget announcements for oil refineries, cement and fertilizer sectors. UK commitment for 1.4b pounds for Pakistan development assistance was taken positive despite concerns for rising fiscal deficit, said a market analyst. Deregulation of fuel prices was indeed taken positive by the market participants, thus allowing the entire E&P sector to display strength, duly backed by turnover, reduction in local fuel prices, a positive for inflation along with popular rumour echoing in the arena regarding likely reduction in cash margin requirement, likely to be replaced with shares, in leverage markets, including deliverable future and MTS seemingly geared up the resident participants, for renewed activity. Although turnover and value of traded, shares stayed on higher side, the momentum yet again failed to match the expectations, thereby indicating high participation by the active participants, while sideliners stayed glued to the visitors gallery, most probably waiting for materialisation of high expectations from the federal budget. , with specific to taxation mechanism applicable on equity market trade, however added nervousness due to awkward economic and financial situation, volatile political and geo-political environment, is likely to impact even after positives in the federal budget, reduction in cash demands for leverage products and materialization of proposed change in CGT mechanism is likely to allow increase in market turnover, and restart effective price discovery, according to the market analyst.

Tuesday, April 16, 2024

KSE gains 141 points ahead of budget

Israeli Air Force finalizes preparations for possible attack on Iran

8:21 AM | April 16, 2024

Abducted minor girl rescued within 12 hours

April 16, 2024

Six illegal constructions demolished in LDA operation

April 16, 2024

LWMC completes special waste operation in key areas

April 16, 2024

Political Reconciliation

April 16, 2024

Pricing Pressures

April 16, 2024

Western Hypocrisy

April 16, 2024

Policing Reforms

April 15, 2024

Storm Safety

April 15, 2024

Democratic harmony

April 16, 2024

Digital dilemma

April 16, 2024

Classroom crisis

April 16, 2024

Bridging gaps

April 16, 2024

Suicide awareness

April 15, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024