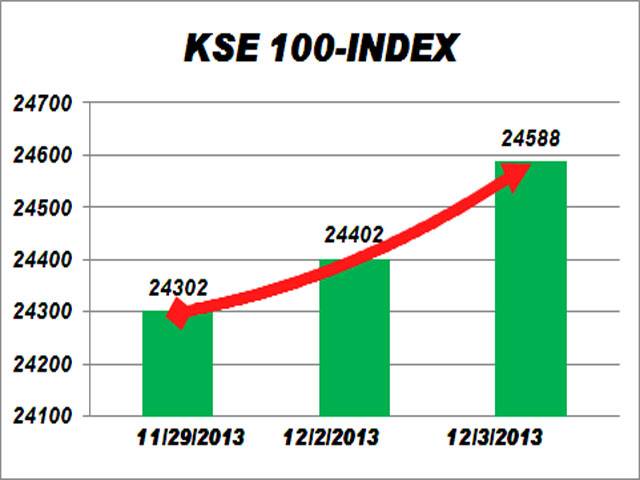

KARACHI - Stocks closed bullish amid higher trades led by stocks across the board on strong valuations momentum at the bourse continued as benchmark index closed at yet another high of 24,588 points with impressive market participation.

Bullish spell continued in the market with addition of 186.90 points in the bench mark. KSE-100 index closed the trading at 24588.47 points compared to 24401.57 points of the previous day.

Analyst at Arif Habib, Ahsan Mehanti said recovery in global commodities, renewed foreign interest and hopes for stability in rupee dollar parity after IFC approval for assistance in issue of euro dollar and rupee bonds and government initiatives on privatisation of SOEs played a catalyst role in bullish sentiments despite concerns for double digit CPI Inflation data for Nov’13.

Improved fertilizer sales data for Nov’13, higher local cement prices and unchanged oil refineries LPG prices for Dec ‘13 kept sentiments positive in fertilizer, oil and cement sectors, he added.

KSE-Allshare index grew by 177.23 points or 0.98 percent to end the day at 18240.62 points, KSE-30 share index gained 152 points or 0.83 percent to conclude the session at 18486.29 points while KMI-30 share index increased by 274.08 points or 0.67 percent to finish the day at 41088.17 points.

The day turnover in term of shares was 185.218 million after opening at 156.607 million shares. Traded value of shares scaled to Rs 10.361 billion from Rs 9.335 billion while the capitalisation of the market settled at Rs 5.949 trillion compared to Rs 5.891 trillion of a day earlier.

Out of 363 companies 217 closed in positive and 124 in negative while the value of 22 stocks remained intact. Unilever FoodsXD was the biggest price gainer up by Rs 532.20 to Rs 11176.20 followed by Rafhan MaizeXD up by Rs 300 to Rs 7800. Wyeth Pak Ltd was the biggest loser of the day decreased by Rs 252 to Rs 4948 followed by Exide (PAK) XDXB down by Rs 15.30 to Rs 298.20.

Dealer Asad Siddiqui said volumes for the day were recorded at Rs10.4b up 11pc. Despite negative news surrounding cement sector’s pricing power, investors remained interested in FCCL and MLCF. Moreover, with ECC meeting underway interest was also seen in Engro which closed on its upper cap. FCCL remained the volume leader with 19.2mn shares traded; ENGRO remained 2nd with turnover of 11.5mn shares followed by MLCF, which saw volume of 10.0m shares.

Fauji CementXD topped the active list with 19.231 million shares as it closed at Rs 13.59 after opening at Rs 13.64. Engro Corporation was on the second position with 11.454 million shares grew by Rs 5.83 to Rs 156.23. It was followed by Maple Leaf Cement with 10.046 million shares up by Re 0.09 to Rs 26.09, PTCLA with 7.424 million shares higher by Re 0.12 to Rs 29.86 and JS Co with 6.130 million shares enlarged by Rs 0.16 to Rs 8.73.

Friday, April 19, 2024

Bullish spree continues as KSE gains 187 points

Opposition objects to oath-taking of MNAs amid lawlessness

5:15 PM | April 19, 2024

Electioneering to end on Friday night ahead of by-polls in 21 constituencies

5:14 PM | April 19, 2024

Fawad Chaudhry granted bail in 14 cases related to May 9 violence

5:13 PM | April 19, 2024

British Army chief lauds Pakistan Army's professionalism, expertise

5:12 PM | April 19, 2024

Israeli aircraft fire missiles at Air Force assets in Iran: Report

3:52 PM | April 19, 2024

A Tense Neighbourhood

April 19, 2024

Dubai Underwater

April 19, 2024

X Debate Continues

April 19, 2024

Hepatitis Challenge

April 18, 2024

IMF Predictions

April 18, 2024

Kite tragedy

April 19, 2024

Discipline dilemma

April 19, 2024

Urgent plea

April 19, 2024

Justice denied

April 18, 2024

AI dilemmas unveiled

April 18, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024