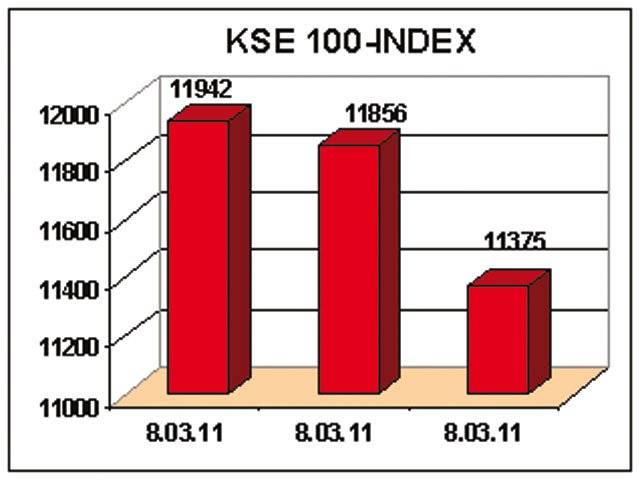

KARACHI (Reuters) - The Karachi stock market suffered heavy losses on Friday as foreign investors offloaded their holdings amid a global sell-off, while local investors remained cautious, dealers said. The Karachi Stock Exchanges benchmark 100-share index closed 3.98 per cent or 471.07 points lower at 11,375.09, its lowest close since March 21, on turnover of 113.17 million shares. The fresh pressure on the KSE is coming from the regional and global sell-off and as it is, the local bourse was already fragile because of the security situation, said Sajid Bhanji, director at Arif Habib Ltd. The market is likely to remain under pressure in the coming days, said Bhanji. The market shed 6.7 percent this week. Dealers said that upcoming strong corporate announcements also may do little do boost investor sentiment. Though the corporate earnings in Pakistan will post above average growth, depleting market depth may cause market volatility in case foreigners tried to dump shares to reduce their exposure to frontier and emerging markets, said Farhan Mahmood, analyst at Topline Securities. This was the same trend that was observed today (Friday). APP adds from Lahore and Islamabad: Lahore Stock Exchange on Friday witnessed bearish trend, with the LSE-25 index loosing 149.33 points to close at 2762.06 points. . The markets overall situation, however, corresponded to an upward trend as it remained at 3.377 million shares to close against previous turnover of 1.632 million shares, showing a difference of 1.744 million shares. While out of the total 92 active scrips, only 2 moved up, 37 remained equal and 53 shed value. Flying Cement Company Limited and Adamjee Insurance Company were major gainers of the day by recording increase in their per share value by Re 0.98 and Re 0.44 respectively. Pakistan Oil Fields Limited, MCB Bank Limited, and Oil and Gas Development Corporation Limited lost their per share value by Rs 10.00, Rs 9.17 and Rs 7.32 respectively. Islamabad Stock Exchange also closed lower on Friday. The index fell by 136.55 points to close at 2529.63 points. Manager First National Equity Pvt Ltd, M M Hassan said that persisting bearish trend in international markets due to US debt concerns was the main reason of panic selling by local institutions. He said that the major investors had accumulated blue chips counters at lower level of index. Senior Equity Dealer, Ismail Iqbal Pvt Ltd, Zaheer Ahmed told APP that the panic selling by major institutions caused bearish trend in the markets because of decline in the major international markets. He said that keeping in the view financial corporate results to be expected in the near future, the market was oversold at this level. Total shares traded were 97,507, which were up by 43,857 as compared to previous day.

Tuesday, April 16, 2024

KSE crashes with 471-point loss amid global sell-off

‘Rain disrupts power supply from 120 feeders’

April 16, 2024

Massive plantation vital to avert floods, climate change

April 16, 2024

Ministers visit rain-hit areas of Peshawar

April 16, 2024

Policing Reforms

April 15, 2024

Storm Safety

April 15, 2024

Deterrence Restored

April 15, 2024

IMF Challenges

April 14, 2024

Security Crisis

April 14, 2024

Suicide awareness

April 15, 2024

Biden’s dilemma

April 15, 2024

Over dependence on technology

April 14, 2024

Education reform call

April 14, 2024

Brain drain

April 14, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024