KARACHI

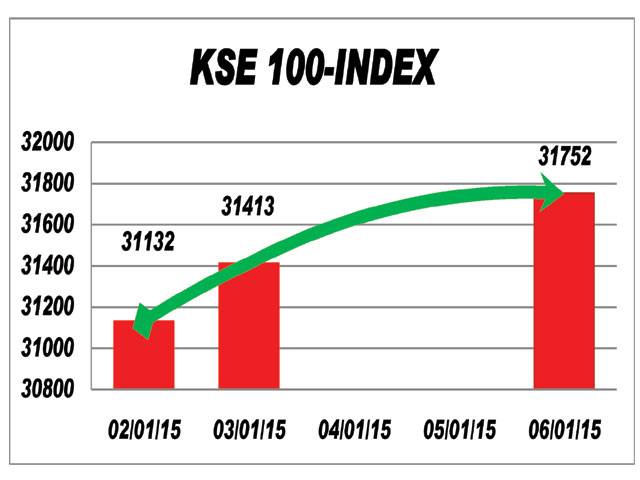

Another bullish session was witnessed at KSE on Monday on investor speculation ahead of quarter earnings announcements. The benchmark KSE 100-index jumped 338 points or 1% to close at 31,752 points.

Volumes traded at the bourse were 241m shares (Rs13.7b/ $134.9m) compared to 285m shares traded in the previous trading session.

Bourse continued its rally for a 5th consecutive session on the back of institutional support. Investors’ sentiments further improved after Pakistan Tehreek-e-Insaf (PTI) announced its decision to join the ongoing session in National Parliament, commented Samar Iqbal VP at Topline Securities. JSCL closed at its upper limit for a 5th consecutive session after news of selling HUMNL shares. PAEL continued to rally after posting a robust full year result. It closed at its 5% upper limit for a 5th consecutive trading session.

Engro Foods (EFOODS) closed at its upper cap as investors are anticipating better March earnings. Engro Corporation (ENGRO), the parent company of EFOODS, also rallied as a result.

The market opened the week on a bullish note as Pakistan Petroleum went up 3.45% and Engro Corp 3.31% gained on institutions coming in to buy blue chip stocks. Engro Foods rose 5% hit limit up as the company qualified as a Shariah compliant stock on the back of latest results. Oil stocks rallied on the back of global oil prices gaining as PPL led gains in the sector.

High dividend yield stocks were also flavor of the day as investors chased high cash payout stocks in the face of a declining interest rate scenario. POL up by 1.74% and FFC by 0.66% were notable gainers in this space. Pak Elektron gains 5% continued its euphoric run on impressive growth in earnings of over 120% in the result for year ended 2014, stated analyst Ovais Ahsan.

Trade remained high led by fertilizer, cement and telecom scrips on strong valuations. Oil stock showed recovery amid rise in WTI crude prices and revision in local petroleum prices. Banking stocks battered as investors’ eye likely institutional interest on government offer for HBL shares through book building from April 7, said analyst Ahsan Mehanti.

Friday, April 19, 2024

Bourse continues rally for 5th session

Sports Minister opens gymnasium hall, multi-purpose stadium

April 19, 2024

3.5-magnitude earthquake hits Quetta

1:10 AM | April 19, 2024

US Ambassador Blome discusses bilateral ties with Foreign Minister Dar

1:08 AM | April 19, 2024

Hepatitis Challenge

April 18, 2024

IMF Predictions

April 18, 2024

Wheat War

April 18, 2024

Rail Revival

April 17, 2024

Addressing Climate Change

April 17, 2024

Justice denied

April 18, 2024

AI dilemmas unveiled

April 18, 2024

Tax tangle

April 18, 2024

Workforce inequality

April 17, 2024

New partnerships

April 17, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024