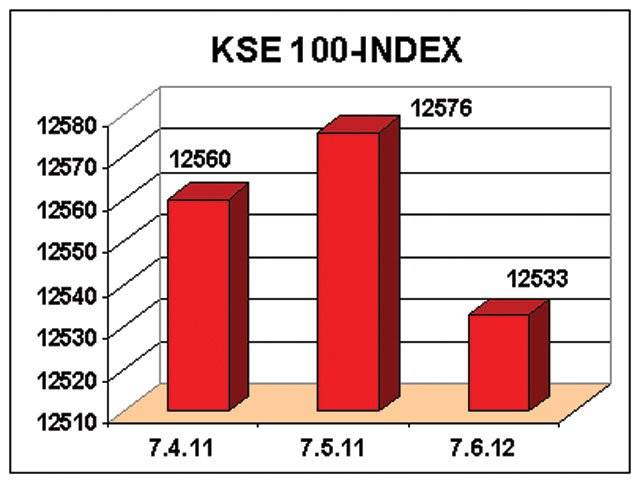

OUR STAFF REPORTER KARACHI - The Karachi stock market witnessed a bearish trading session on Wednesday due to limited buying from the retail and institutional investors. The KSE 100-share index fell by 42.93 points or 0.34 per cent to close at 12,533.55 points. The market turnover declined to 68.50 million shares compared to 71.55 million shares traded previously. Ahsan Mehanti, Director at Arif Habib Investments, said that concerns over Karachis deteriorating law and order and rising fiscal deficit affected the market sentiment. Strong valuations in blue chip scrips, rising local urea prices, expectations for record earning announcements in commodity scrips for this fiscal year supported the market throughout the earning announcement session, he said. Hasnain Asghar Ali, a senior analyst at Aziz Fida Husein & Co, said that the gains laid by fertilizer and chemical stocks continued to reflect the activity in the frontline stocks, wherein gainers outperformed the losers, with least reflection of illiquid stocks was poised towards positive zone, despite sell-off in various high priced stocks. Various stocks from chemical and fertilizer sectors, duly followed the bull-run initiated by Fauji group stocks , however the fertilizer stocks under threat from various fronts, failed to invite follow-up support and wider interest. Group support however allowed the stock to join the gaining spree. Presence of sellers on strength restricted the upside in various gainers from previous session, mainly from E&P, cement and banking sectors. Rangebound activity did restrict activity by resident participants. Opportunities of sector and stock swapping provided due to gaining spree in various main board stocks, was well capitalized by corporate participants, he said. Although upcoming results, mainly by the companies likely to announce financial year end results for June 30,11 is being portrayed as a trigger, caution that is visible and is recommended, snap rallies on optimism may however provide profit taking opportunities, mainly in the high priced stocks, unlikely to sustain the running multiples due to curtailed local strength, he added.

Saturday, April 20, 2024

KSE witnesses bearish session

ATC extends interim bails of Aleema, Uzma Khan in Jinnah House attack case

10:42 AM | April 20, 2024

Volcanic eruptions in Indonesia affect thousands of passengers

10:30 AM | April 20, 2024

Freedom Flotilla prepares for humanitarian aid delivery to Gaza

9:14 AM | April 20, 2024

Sindh govt signs lease land accord for Dhabeji SEZ

April 20, 2024

Policitising Tragedy

April 20, 2024

Tehran to Rafah

April 20, 2024

A New Leaf

April 20, 2024

A Tense Neighbourhood

April 19, 2024

Dubai Underwater

April 19, 2024

Dangers of Deepfakes

April 20, 2024

Feudalism

April 20, 2024

Kite tragedy

April 19, 2024

Discipline dilemma

April 19, 2024

Urgent plea

April 19, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024