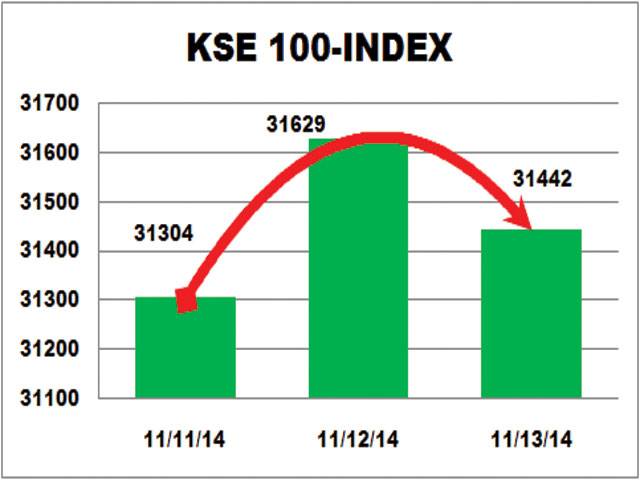

Karachi - Profit-taking witnessed in overbought market. Trade remained high amid expectation for limited change in SBP policy rate stance due on Nov 15 after stagnant yields in T-Bill auctions.

At local equity market benchmark KSE-100 share index shed 187.38 points or 0.59 percent to end the day at 31441.82 points compared to 31629.20 points of the previous day. Ahsan Mehanti analyst at Arif Habib Corp said dismal data of $8.8b trade deficit for Jul-Oct’14, FBR clarification for no exemption on capital gains tax to foreign institutional buyers, concerns for political tension in Sindh province and uncertainty outlook for privatisation of SOEs played a catalyst role in bearish activity at KSE. KSE-Allshare index misplaced 141.40 points or 0.60 percent to stop the trading at 23283.02 points, KSE-30 index off by 131.68 points or 0.63 percent to finish the session at 20608.44 points while KMI-30 index decreased by 383.59 points or 0.76 points to conclude the trading at 50281.30 points. Trading took place in 428 companies where 163 stocks closed in green and 252 in negative while the value of 13 stocks remained intact. Highest decreased reflected in the price of Rafhan Maize down by Rs 444.20 to Rs 10700.01 followed by Nestle Pak.XD off by Rs 95 to Rs 8805. Unilever Foods SPOt and Exide (PAK) were the biggest price gainers of the day up by Rs 293 to Rs 9690 and Rs 91.85 to Rs 1928.97.

Market traded 305.027 million shares after opening at 322.883 million shares and the value of traded shares was declined to Rs 16.513 billion from Rs 19.310 billion. The capitalisation of the stock market maintained at Rs 7.338 trillion compared to Rs 7.385 trillion of a day earlier.

Active list was topped by Pak.Int.Bulk with 20.171 million shares grew by Re 0.66 to Rs 23.91. JS Co was the second highest on volume chart with 20.019 million shares higher by Re 0.95 to Rs 13.95.

It was followed by Engro Fertilizer Ltd with 14.919 million shares added Re 0.78 to Rs 64.78, Adamjee Ins with 13.320 million shares off by Re 0.54 to Rs 48.46 and Japan Power with 9.582 million shares grew by Re 0.27 to Rs 3.04.

Thursday, April 18, 2024

KSE sheds187pts on Sindh political tension

10:01 AM | April 17, 2024

Jailed Myanmar leader Suu Kyi moved to house arrest

April 18, 2024

Jahangir Khan PSA Satellite Squash Series strats

April 18, 2024

Pakistan women face West Indies women in first ODI today

April 18, 2024

Asad, Amir reach PTLA Junior National Tennis semis

April 18, 2024

Rail Revival

April 17, 2024

Addressing Climate Change

April 17, 2024

Saudi Investment

April 17, 2024

Political Reconciliation

April 16, 2024

Pricing Pressures

April 16, 2024

Workforce inequality

April 17, 2024

New partnerships

April 17, 2024

Shikarpur crisis

April 17, 2024

Peace quest

April 17, 2024

Democratic harmony

April 16, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024