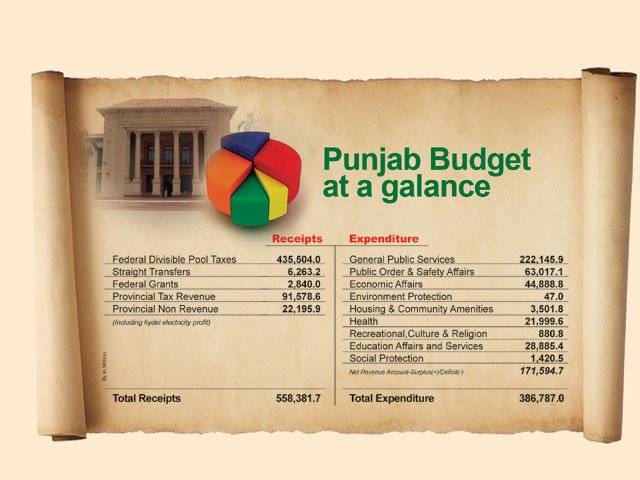

LAHORE The PML-N-led government in Punjab on Monday presented its third budget for the fiscal year 2010-11 with a total outlay of Rs 583.6 billion, including a record allocation of Rs 193.5 billion for the Annual Development Programme (ADP). Last year, the total budget outlay stood at Rs 489 billion. The government also announced 50 per cent increase in the salaries of provincial employees as monthly adhoc allowance. On the other hand, the salaries of the provincial ministers have been slashed by 25 per cent while the office expenditure of ministers and the Chief Ministers Secretariat is also reduced by 25 per cent. Furthermore, all the ministers and govt servants would use the official vehicles in accordance with their entitlement only. Provincial Finance Minister Tanvir Ashraf Kaira in his budget speech termed the budget as 'tax-free, balanced, public friendly and development oriented. According to the budget document, the general revenue receipts for the fiscal year 2010-11 have been estimated at Rs 558.38 billion with a revenue expenditure of Rs 386.78 billion while the net revenue expenditure is given as Rs 365.78 billion. Another Rs 21 billion allocation has been made for pro-poor subsidies. The government has also estimated Rs 171 billions net revenue surplus for the forthcoming fiscal year. According to the general revenue receipts estimates, the province would get Rs 435.50 billion from the Federal Divisible Pool under the new NFC Award while the straight transfers at Rs 6.2 billion besides federal grants at Rs 2.8 billion and provincial taxes at Rs 91.57 billion have been estimated. The provincial non-tax revenue, including hydel electricity profit, would contribute Rs 22.195 billion in the general revenue receipts. Hence, there would be Rs 171 billion net revenue surplus. The Punjab government has also earmarked record allocation for social sector development project, law and order and welfare-oriented projects to provide relief to the poor people. Addressing the budget session at the Punjab Assembly, Kaira said the province would get additional resources of Rs 98 billion during next fiscal year including Rs 51 billion under head of Federal Divisible Pool and Rs 47 billion under the head of GST on services. He further said the govt had reserved Rs 49.20 billion for police in order to improve its functioning. He said the allocation for pro-poor subsidies had been increased from Rs 15 billion to Rs 21 billion, as Rs 13 billion subsidy would be given on wheat, Rs five billion would spent on Sasti Roti Scheme, Rs two billion for Ramazan package and Rs one billion subsidy would be given on public transport. He further said the govt would also give Rs two billion subsidy on solar-powered pumps during the next fiscal year. He said during the next fiscal year, an amount of Rs two billion was proposed for Punjab Education Endowment Fund while Rs 4 billion had so far been spent on the project. He said the govt had allocated Rs 53.99 billion for education sector for new and ongoing development schemes, which was 12 per cent more than the current years allocation. The government had also proposed Rs six billion allocation to provide medicines to the patients in the public hospitals of the province. The minister also added that the govt had proposed a total allocation of Rs 43.80 billion for health sector for ongoing and new development schemes, showing a 16.6 per cent increase in comparison with current fiscal year. The government also announced to set up four new medical colleges in Dera Ghazi Khan, Sahiwal, Gujranwala and Sialkot while an amount of Rs 21 billion would be spent on development projects in the health sector. According to the budget document, the govt has allocated Rs 3.20 billion for agriculture sector with major focus on research-oriented projects. The finance minister also announced 15 per cent increase in the pension of provincial employees who had retired after 2001 while those who had got retirement before 2001 would get 20 per cent raise. The govt in the Punjab Finance Act 2010 has also proposed 50 per cent cut in Capital Value Tax (CVT) on the sale and purchase of property. The move came after the declaring the CVT as a provincial subject. The provincial government has proposed two per cent CVT against the existing four per cent. However, the tax on services, which has been transferred to provinces, would be collected according to the existing federal formula. According to the Punjab Finance Act, as a consequence of the Constitution (18th Amendment) the value of all types of taxes, including capital value tax, on the immoveable property is now within the exclusive domain of the province. In line with the 7th NFC Award, the provincial government intends to levy GST on telecommunication services along with those of shipping agents, stockbrokers, banking, insurance and advertisement by cable television, according to the Finance Act. The Finance Act furthers says that the enhancement in the authorised capital of the Bank of Punjab is necessary to enable the Bank of Punjab to comply with the prudential regulations of the State Bank of Pakistan and to issue the right of shares. The other amendment would provide an option to the Punjab government to off-load some shares of the bank at an appropriate time, the Finance Act added.

Thursday, April 18, 2024

No new tax in Punjab budget

ITP cracks down on traffic violations

April 18, 2024

Illegal housing societies in Rawalpindi to face crackdown

April 18, 2024

SZABIST traffic volunteers visit Safe City Islamabad

April 18, 2024

Police pledges swift resolution of public issues

April 18, 2024

QS Ranking: QAU top among Pak universities, 315th globally

April 18, 2024

Hepatitis Challenge

April 18, 2024

IMF Predictions

April 18, 2024

Wheat War

April 18, 2024

Rail Revival

April 17, 2024

Addressing Climate Change

April 17, 2024

Justice denied

April 18, 2024

AI dilemmas unveiled

April 18, 2024

Tax tangle

April 18, 2024

Workforce inequality

April 17, 2024

New partnerships

April 17, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024