ISLAMABAD - The Supreme Court on Friday issued a list of 222 individuals who got their loans written off to the tune of Rs54 billion from different banks.

On May 13, a two-member bench headed by Chief Justice Mian Saqib Nisar and comprising Justice Mushir Alam heard the suo motu case of 2007, taken by the then CJP Iftikhar Muhammad Chaudhry.

“As per the report of the commission constituted by this court, action against 222 individuals/companies (page No107 of Vol-I of Commission’s Report) has been recommended on account of the fact that the loans were not written-off in accordance with law,” the top court said in its written order.

“Let notice be issued to all 222 individuals/companies per detail provided in part-II of volume-II of the report of the “Commission on written-off loan” against whom action is recommended for further action; ensure their presence at the next date of hearing and to submit their replies before such date,” the top court further ruled in its written order.

“Therefore, in compliance with the above the court order following individuals/companies have been issued notices to ensure their appearance at the next date of hearing ie 08.06.2018 and submit their replies before such date,” it further said.

Three companies including M/s Afghan Ghee Industries, M/s Imala Ghee Mills and M/s Shahlala Plastic Industries got their loans write off from the Bank of Khyber, the report said.

Ninety two of those individuals and companies who got their loans written off from Habib Bank Ltd include M/s Abbas Engineering, M/s Abbas Steel Industries, M/s Adamjee Garments, M/s Ahmed Food Industries, M/s Ajax Industries (Adamjee Group), M/s Al-Abbas Fabricos, M/s Alif Textile Industries, M/s Al-Jadeed Textile Mills, M/s Allama Textile Mills, M/s Al-Muqeet International, M/s Alpha Special Steel Casting, M/s Ashraf Impex & M.H. International, M/s Aslam Cotton (G&P) Factory, M/s Ayaz Textile Mills, M/s Aziz Spinning Mills, M/s Bolan Beverages, M/s Continental Beverages, M/s Continental Rice Mills, M/s Dascon, M/s Fabritex Industries, M/s Farooq Ahmed Cotton Mills, M/s Ghulam Mohammad Dossul & Company, Golden Valley Trading (Adamjee Group), M/s Harrapa Textile Mills, M/s Ibex Textile Mills, M/s Industrial Sacks, M/s Ink Chemicals, M/s Iram Textile Mills, M/s Jam Sher Ali Khan, M/s Kaisar Arts & Krafts, M/s Kakasian Feeds, M/s Kakasian Oil, M/s Kakasian Packages, M/s Karim Cotton Mills, M/s Karim Silk Mills, M/s Kashif Steel Industries, M/s Kassam Sons, M/s Dhedi Ind. (Kassam Group), M/s Khalil Jute Mills, M/s Kiran Enterprises, M/s Kotri Textile Mills, M/s KPL Papers, M/s Kurdistan Trading Co, M/s Kwality Paper, M/s Latif Shakir Textile Mills, M/s Lion Steel Industries, M/s M.K. Fast, M/s M.S. Sports Wear, M/s Madina Paper & Board Mills, M/s Marrium Garments, M/s Marvi Industries, M/s Mercury Garments, M/s Milkways, M/s Mountain Valley Water, M/s Mubarak Textile Mills, M/s Muhammad Farooq AR, M/s Naqi Beverages, M/s National Auto Bulbs, M/s National Woolen Mills, M/s Nature Farm Products, M/s Niaz Knitwear, M/s Novelty Fabrics Limited, M/s Nutripak Food Industries, M/s Orient Rice Mills, M/s Pak Asia Industries, M/s Pakistan National Textile Mills, M/s Paper Chem, M/s Paper Packaging, M/s Petro Commodities, M/s Provenco, M/s Prudential Textile Mills, M/s Qasim Textile, M/s Qayyum Spinning Mills, M/s Rabka Breeding Farm, M/s Razik Engineering, M/s Reliable Business Associate Group, M/s Sahil International, M/s Sakhi Silk Mills, M/s Sarbaz Traders, M/s Schon Knitwear, M/s Service Fabrics, M/s Shafiq Textile Mills, M/s Shakir Latif Industries, M/s Shepherd & Shepherd, M/s Sinsas Enterprises, M/s Taha Spinning Mills, M/s Thermax Pakistan (Pvt), M/s Tobacco Industries, M/s Yasmeen Weaving Mills, M/s Zahid Rajput Developers, M/s Zamir Textile Mills and M/s Zar Jabeen Textile Mills.

Likewise, 15 of those individuals and companies who got their loans written off from the Industrial Development Bank of Pakistan include M/s Azeem Food Industries, M/s Bela Ghee Mills, M/s Big Mak Foods, M/s Century Industries, M/s Hakim Textile Mills, M/s Hala Spinning Mills, M/s Jet Era Textile, M/s Kraft Kit, M/s M.S. Enterprises, M/s Misto Industries, M/s National Video Industries, M/s Pak Absorbent Inds, M/s Pak Weavers, M/s Reshi Textile Mills and M/s Rubicon Industries.

Similarly, those 70individuals and companies who got their loans written off from the National Bank of Pakistan (NBP) include M/s Adamjee Garments Industries, M/s Adamjee Industries, M/s Al-Asif Sugar Mills, M/s Aleem Sons, M/s Al-Hassan Enterprises, M/s Ali’S Knitwear, M/s Al Shams Industries, M/s Aslam Taxtan, M/s Associated Ind Garments, M/s Attock Engineering, M/s Attock Textile Mills, M/s Ayyaz Textile Mills Limited, M/s Balochistan Manufactures, M/s Batala Ghee Mills, M/s Bawany Industries, M/s Bela Ghee Mills Limited, M/s Chaudhry Electrodes Ind, M/s Chauhan Vegetable Ghee Mills, M/s Choti Textile Mills, M/s Crescent Jute Products, M/s Digital Communication, M/s Electronic Information & Energy System, M/s Expo International (Taj group), M/s F.F. Cans, M/s Fatima Food Industries, M/s First Tawakkal Modaraba, Foot Care, M/s Frontier Pharmaceutical, M/s Glamour Textile Mills, M/s Haji Mohammad Ismail Mills, M/s Harrapa Textile Mills, M/s Ice Pak Limited, M/s Jahangir Fabrics, M/s Kashmir Polytex Limited, M/s Nick Fung Textile Company, M/s Kunzan Textile Mills, M/s Mehr Dastgir Leather Ind, M/s Mehr Dastgir Spinning Mills, M/s Metro Garments & Hosiery, M/s Mumtaz Shabaz Textile, M/s Myco Industries, National Garments, M/s Oberoi Textile Mills, M/s Pak Green Fertilizer, M/s Pakistan National Textile Mills, M/s Pak Daud Cement, M/s Pak Land Cement, M/s Paras Textile Mills, M/s Polysacks, M/s Power Textile Industries, M/s Quality Steel Works, M/s Quality Weaving Mills, M/s Qurel Cassettes, M/s Rafique Textile Mills, M/s Rakshani Paper Board, M/s Rehmat Industries, M/s Reshi Textile Mills, M/s Saadi Cement (Dewan group), M/s Saigal Ghee Mills, M/s Sak Garments & Hosiery, M/s Shama Textile Industries, M/s Sheikhoo Cooking Oil Mills, M/s Sidra Rice Mills, M/s Siftaq International Limited, M/s Siraj Steels, M/s Spectrum Chemicals, M/s Taj Solvex, M/s Taymoor Spinning Mills, M/s Ulbricht’S Pak and M/s Zeenat Marble Industries.

Those who got their loans written off from the Muslim Commercial Bank (MCB) include M/s Frontier Dextrose, M/s Gadoon Synthatics, M/s Multiwhite Blocks and M/s Sindh Textile Industries while PLHC Bank written off the loans of M/s Bella Chemicals, M/s Chakwal Chemical, M/s Ferro Alloys, M/s Northern Chemicals, M/s Solvex Industries and SME Bank written off the loans of M/s Dynasty Hotel, M/s Flower Oil Mills, M/s Jaguar Knitting, M/s Monarch Knitwear, M/s Pasban Soap Industries, M/s Salar Textile Mills and M/s Sharik International.

The United Bank Ltd (UBL) written of the loans of M/s Mehr Din Pak Industries, M/s Nabeel Fibre, M/s Peshawar Pipe Mills, M/s Rahim K. Sheikh Transporters while Zarai Taraqiati Bank Ltd (ZTBL) written of the loans of M/s AM Pak Dairies, M/s A-One Chicks and Feed Mills, M/s Batrax, M/s Compact Particle Board, M/s Farooq Habib Textile Mills, M/s Fiber Board Industries, M/s Imran Oil Extraction, M/s Kabir Fertilizer, M/s Kiran Sugar Mills, M/s Langar Sulemani Industries, M/s Mian Muhammad Sugar Mills, M/s Milkways Lahore, M/s Monno Dairies, M/s Mubarak Dairies, M/s Multan Edible Oil, M/s Pak Green Fertilizer, M/s Pakpattan Dairies, M/s Punjnad Polypropylene, M/s Quantic Leather Craft, M/s Ravi Agricultural and Dairy, M/s S.S.Oil Mills, M/s Shan Feed Mills, M/s Suraj Mukh Company, M/s Techno Agricultural Industries and M/s Transtech.

On April 26, Chief Justice Nisar during the hearing had expressed his annoyance over the written-off loans on political basis and expressed the determination for recovery of illegally written-off loans even if it required seizure of the beneficiaries’ assets.

The chief justice had observed that it was a message to those who have waived-off the loans illegally that this money will be recovered even if such step required the seizure of shares, units or assets. The top judge had added that every single penny will be collected from them.

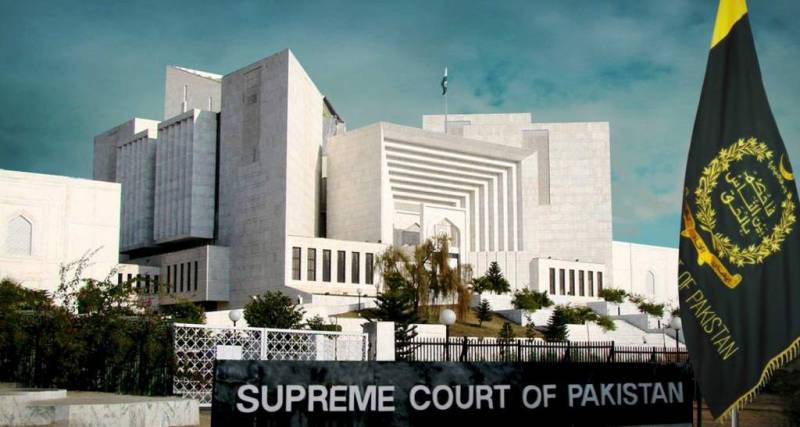

SC issues list of 222 loan beneficiaries

SYED SABEEHUL HUSSNAIN