KARACHI - Selective stock picking was seen at Karachi stock market on Monday. MLCF and FCCL remained in the limelight on expectation of better December quarter results. FFC also performed well ahead of its result. Interest was also seen in closed-end funds.

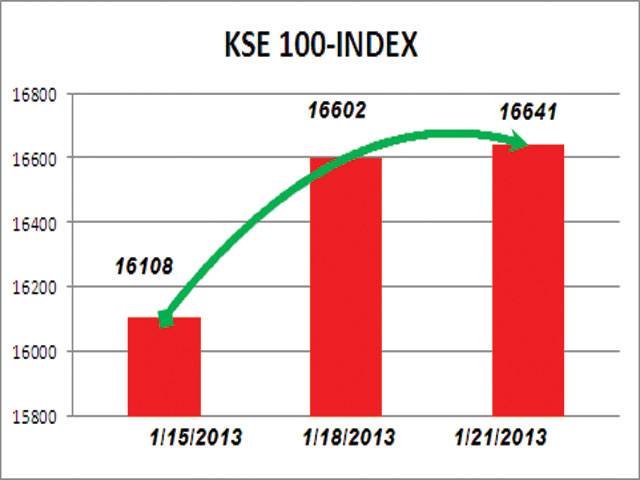

The Karachi Stock Exchange benchmark KSE 100-index gained 39.04 points or 0.24 per cent to stop the day at 16640.81 points as compared to 16601.77 points of the last working day on Friday. KSE allshare-index added 29.09 points or 0.25 per cent to finish the day at 11726.03 points, KSE 30-index went higher by 38.15 points or 0.28 percent to conclude the day at 13580.35 points while KMI 30-share index was up by 46.81 points or 0.16 percent to stop the day at 28781 points.

An expert said investor sentiments remained bullish on strong earnings outlook in blue chip stocks across the board. Higher global commodities and current account surplus of $250m reported for first half of this fiscal year played a catalyst role in bullish close in stocks at KSE amid hopes for positive Pak-IMF talks.

Market traded 128.251 million shares as compared to 181.723 million shares of the previous day and the value of traded shares reduced to Rs 3.728 billion from Rs 3.997 billion. The capitalization of stock market settled at Rs 4.155 trillion compared to Rs 4.145 trillion of a day earlier. During the session, 334 companies participated in the trading where 156 closed in positive and 146 in negative while the values of 32 stocks remained intact. Rafhan Maize Prod was the biggest loser of the day, down by Rs 185 to Rs 3515, followed by Unilever Food, down by Rs 178 to Rs 4000. Bata (Pak) and MithchellsFruit SPOT were the top price gainers of the day, up by Rs 20 to Rs 1250 and Rs 15 to Rs 395.

In the top ten scrips, Maple Leaf Cement was the volume leader of the day with 16.118 million shares as it closed at Rs 15.92 to Rs 15.64. Fauji Cement was on the second position with 13.585 million shares, shed Re 0.07 to Rs 7.30. It was followed by Byco Petroleum with 8.716 million shares, shed Re 0.08 to Rs 13.90, JS Co with 8.601 million shares lost 0.40 to Rs 15.30 and JS Growth Fund with 7.005 million shares went up by Re 0.94 to Rs 9.99.

Friday, April 19, 2024

KSE index gains 39 points on strong earnings outlook

No damage to Iranian nuclear sites after Israeli airstrikes, says UN nuclear watchdog

12:50 PM | April 19, 2024

Ch Shafay visits Directorate of Consumer Protection Council

April 19, 2024

ECP reviews arrangements for by-elections in Punjab

April 19, 2024

Punjab’s price control initiative: A welcome step

12:33 PM | April 19, 2024

A Tense Neighbourhood

April 19, 2024

Dubai Underwater

April 19, 2024

X Debate Continues

April 19, 2024

Hepatitis Challenge

April 18, 2024

IMF Predictions

April 18, 2024

Kite tragedy

April 19, 2024

Discipline dilemma

April 19, 2024

Urgent plea

April 19, 2024

Justice denied

April 18, 2024

AI dilemmas unveiled

April 18, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024