ISLAMABAD - A staggering $15.253 billion (over 1.82 trillion rupees) was transferred abroad by individual account holders during the financial year 2016-17 ‘through normal banking channels’.

A substantial amount was also shifted out of the country through illegal means of Hundi and Hawala, revealed a 12-member Supreme Court-appointed committee.

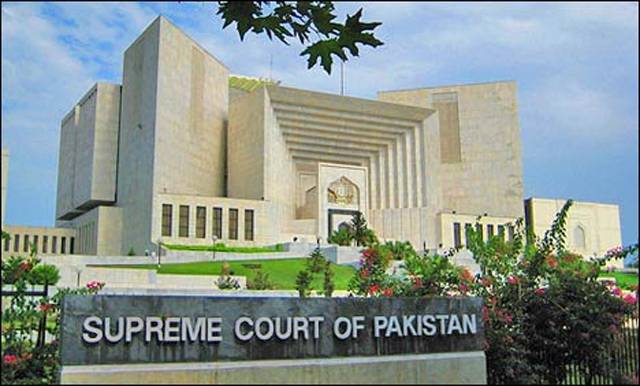

The committee of experts was tasked by the apex court with recommending legislative and executive measures for tracing and retrieving assets held abroad by Pakistanis.

Without giving a numerical estimation, the report suggested that a substantial amount of transfers also took place from Pakistan through illegal means of Hundi and Hawala mechanisms – primarily because of deficiencies in the laws and systemic loopholes.

The committee of a dozen experts was constituted by the top court in a suo moto case pertaining to the maintaining of foreign currency accounts by Pakistani citizens without disclosing the same or paying taxes.

Recommendations have been made by the committee to deal with the said deficiencies under foreign exchange regulation and tax collection rules.

The recommendations have noted the experience of incentive schemes floated in other jurisdictions to encourage voluntary disclosure of foreign assets. These include schemes initiated in the recent past in Italy, India and Indonesia.

It is stated that the tax amnesty scheme 2016 offered in Indonesia was highly successful and the committee has supported its emulation in Pakistan.

The committee has recommended that a scheme for voluntary disclosure of foreign assets owned by Pakistani citizens be announced by the federal government.

“This would provide such declarants with an opportunity to declare and/or transfer their foreign assets to Pakistan in lieu of payment of tax,” the experts recommended.

The committee in the same spirit supported the provisions of Foreign Assets (Declaration and Repatriation) Ordinance, 2018. The committee members had also lent their support for the voluntary disclosure schemes announced by the federal government when a three-judge bench headed by Chief Justice Saqib Nisar took up the case for hearing on June 12.

It was also informed that the government [of Pakistan Muslim League-Nawaz] had made legislative amendments in the relevant laws for curtailing and regulating the cash feeding of foreign currency accounts by restricting that privilege to tax filers only.

“A regulatory check in cash movement of foreign currency above $100,000 within Pakistan has been imposed. Likewise, immunity from taxation of inward remittances under Section 111(4)(a) of the Income Tax Ordinance, 2001 has been limited to a maximum $100,000 per annum,” the court was informed, according to the written order.

The court in its 8-page order observed that it was persuaded to initiate these suo motu proceedings for the grave public interest concerns for two main reasons.

First, the declining foreign exchange reserves of the country, the depreciating exchange rate of the rupee and the corresponding inflationary trend of imported essential commodities which raised concerns.

Second, the ‘governmental indifference’ towards the unhindered outflows of valuable foreign exchange from the economic wealth and resources of the country which was encouraged by immunities from scrutiny and from taxation granted to foreign currency transfers abroad that were also depriving the exchequer of vital tax revenue.

The three-judge bench in its written order observed that the proceedings had aimed to draw the attention of the federal legislative and regulatory bodies toward the key issues pertaining to the matters of national priority.

“The fact that the [outgoing] federal government has brought legislation on the subject is a good start to curtail misuse of privileges granted by the law and executive regulation,” it observed.

Observing that the legislative and regulatory initiatives undertaken by the [PML-N] government in the matter had not been challenged before the court, the top court ruled, “In the absence of a concrete challenge, the court is not inclined to unilaterally sit in academic judgment on the legality or propriety of the provisions of the scheme of voluntary disclosure of foreign assets under the Act, 2018 (Foreign Assets (Declaration and Repatriation) Act, 2018).”

“Also we are not prescient about subtle technicalities of foreign exchange and balance of payment stabilization nor about fiscal or other economic matters so as to anticipate deficiencies in the federal government’s actions,” it added.

The top court also welcomed the measures taken by federal government to protect the foreign exchange reserves of the country.

“It is observed that any measures taken by the federal government in the public interest to protect the foreign exchange reserves of the country and to bring the hitherto undeclared foreign assets within the tax net are welcomed by the court.”

The top court, however, observed that there were other deficiencies of the current tax laws and in the regulatory framework for the holding and transfer of foreign exchange that promoted the accumulation of undeclared foreign assets and corresponding income.

The top court expressed its concern that such issue had been highlighted by the 12-member committee but remained unaddressed by the federal government. “They require careful attention and deliberation by the concerned authorities,” it observed.

The court directed the federal government, Federal Board of Revenue and State Bank of Pakistan to state their respective positions about the deficiencies in current tax laws and other related matters which promote the accumulation of undeclared foreign assets.

Pakistanis remit out trillions each year

SYED SABEEHUL HUSSNAIN