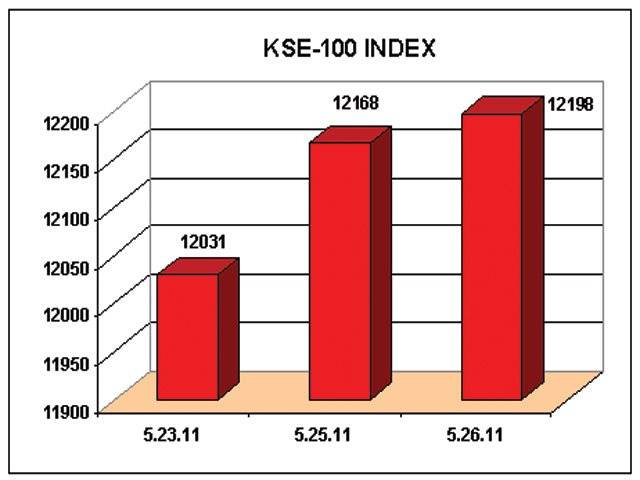

KARACHI - The Karachi stock market closed higher with rising volumes in blue chip scrips across the board on Thursday. The Karachi Stock Exchanges 100-share index gained 30 points or 0.25 per cent and closed at 12,168.12 points, compared with 12,168.12 points of Wednesday. The KSE recorded a high turnover of 101.52 million shares, in contrast to a total of 122.92 million shares traded a day earlier. The KSE market capitalization also increased in value to close at 3,234.67 billion or $37.76 billion from the last days figures of Rs3,225.62 billion or $37.66 billion. Total trading value was recorded at Rs4.15 billion or $48.41 million. The KSE 30-share index surged by 0.15 per cent or 18.27 points to close at 11,821.85 points compared with Wednesdays 11,803.58 points. The KSE future volume shares amounted to 4.89 million shares, valuing at Rs391.15 million at the rate of 7.16 per cent. An analyst at Arif Habib Investments said a positive close was witnessed at the KSE with rising volumes on renewed institutional interest. Rising local power tariff, higher oil refinery margins and recovery in global commodity prices affected the investors sentiments as they were awaiting the outcome of the KSE Board of Directors suggestions sent to the Federal Finance Minister with regard to the changes in capital gains tax. Another analyst at Aziz Fida Husein & Co said value buying in almost all the front liners kept the momentum upbeat as the sector and stocks swapping on strength restricted the gains on the benchmark. With turnover mainly contributed by the front line stocks, the KSE sustained over 100 million mark by showing an increase in value of traded shares and high activity in main board stocks, the analyst said. The elimination of Continuous Funding System (CFS) and Capital Gain Tax (CGT) implementation has proved a double-edged sword thus injuring market turnover (once the selling point) and badly damaging price discovery mechanism, the analyst said, adding that the stocks having the potential of trading at improved multiples, are successfully inviting fresh funds, from local corporate, leverage and retail participants, despite off-loading from off-shore channels, thus depicting confidence revival, despite tougher conditions now, on macro front.

Thursday, April 25, 2024

KSE adds 30 points as buying spree continues

Woman arrested for hit-and-run on traffic officer

April 25, 2024

Police carry out search operations in different areas

April 25, 2024

Moot held on Pakistan in emerging geopolitical landscape

April 25, 2024

Seminary student shot by armed dacoits

April 25, 2024

Musk vs Australia

April 25, 2024

Reforming Rehab

April 25, 2024

Tax It Right

April 25, 2024

Academic Uprising

April 24, 2024

Cooperation Momentum

April 24, 2024

Ending animal suffering

April 25, 2024

AI governance

April 25, 2024

AI concerns

April 25, 2024

Population paradox

April 24, 2024

Unveiling differences

April 24, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024