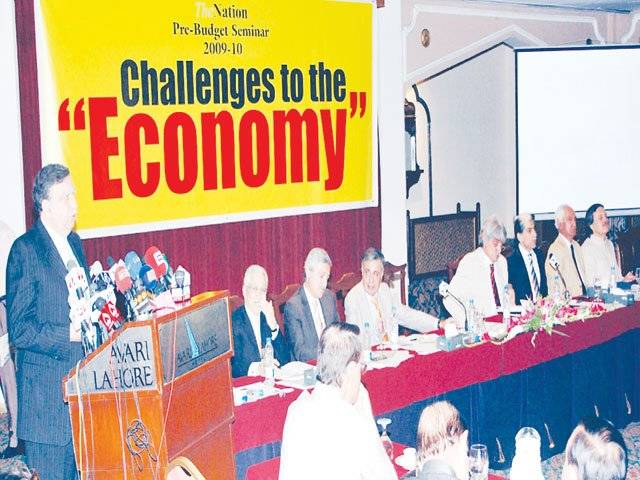

LAHORE - Adviser to Prime Minister on Finance Shaukat Tarin has said that a substantial increase would be incorporated in the budgetary allocations for education and health in the upcoming budget. Speaking at the Pre-Budget Seminar 2009-10 organised by The Nation on Saturday, Tarin regretted the fact that less than two per cent of the GDP was being spent on the education and health sectors in Pakistan. He, however, maintained that in the coming budget the government would make a significant increase in the allocations for the two key social sectors in the country. Vowing not to burden the existing taxpayers with more levies, Tarin said that everyone will have to pay the tax for increasing tax to GDP ratio. Hinting at the extraordinary increase in funds for the education and health in the next budget, he admitted the shame that the successive governments had been spending fractional amount of less than two per cent of GDP on the health and education, but promised to change the trend in the new fiscal policy. Developed nations are having 90 percent literacy, and we would be directionally heading to the same desirable end, he said while promising, You would see more money allocated to these two social sectors in the budget. Tarin assured that there would be no increase in Sales Tax in the budget for 2009-10. He said economic restructuring and self-dependence by optimal utilisation of indigenous resources will be the prime focus of the government in the next budget. Tarin said the allocations for agriculture research and development, dairy and livestock, water and power projects, and upgrading besides establishing new institutions were among his other major initiatives for the budget 2009-10. He listed war on terror, internally displaced people (IDPs), increasing tax to GDP ratio from 9 per cent to 15 per cent (preferably 20 per cent), energy and food security, and attacking poverty as top challenges to the PPP government before formulating the new fiscal policy. According to the Advisor, low interest rates, contained inflation and stable exchange rates were the targets of his government with a special focus on agriculture, manufacturing and infrastructure development. He described privatisation and public private partnership as the means to these ends. In Tarins opinion, the first and the foremost challenge for the government was to go for economic stabilisation when the economy in late last year was faced with domestic economic meltdown, ripples of global economic recession and inflation reaching 25 per cent with food inflation hovering around 33 per cent. Now, he said, the inflation has eased down to 17 per cent and is expected to down further at 13 per cent sometime next month. The target for average inflation rate for the next financial year is to bring it down to single digit. Fixing inflation rate target at six per cent would not be realistic therefore we would try to bring it around 8 to 9 per cent, he added. He also agreed to the points raised by former adviser Dr Salman Shah that wheat price increase from Rs 625 to Rs 950 per 40 kilograms did contribute to the inflationary pressures besides augmenting the oil prices. However, he explained that it was decided to achieve parity in the wheat prices across the country. Three provinces were already paying higher price for wheat before the increase of the wheat support price, he said and added, now the wheat flour price is more or less same across the country at around Rs 27.5 per kg. We have to build up federal strategic reserves, whichever province is having surplus stock must deposit it in order to offset shortage anywhere else, he said. He also presented his startling analysis of the revenue growth over the last decade or so. It is true that tax revenue grew by 2.5 to 3 times but alarming is reduction in tax to GDP ratio that came down from 13 per cent to 9 per cent, he added. He went on to say, Now we need to increase it again to level between 15 to 20 per cent in order to target 8 to 10 per cent economic growth rate. Rather than taking credit for improvement in the current account, he said, it happened only because the oil and commodity prices came down besides the economic growth slowed down from 7 per cent to 2 per cent. We dont have the capacity to arrest current account gap if all these indicators start rising again tomorrow, he said and rushed to add, Therefore increasing exports is another challenge in front of us. After stabilisation, we need to take care of poor of the country. We shall be attacking the poverty by skill development and provision of sustenance. He talked about inefficiency in the power sector including line losses, and corruption in energy and revenue machinery. He also mentioned the joint investment companies namely Pak-Saudi, Pak-Kuwait, and Pak-Oman in terms of redirecting them to infrastructure and industrial growth. Speaking about development, he admitted cuts on Pakistan Sector Development Programme of the ongoing year. But for the coming year, the federal PSDP would grow from Rs 220 to Rs 400 billion. Former federal ministers Jahangir Tareen and Humayun Akhtar Khan, ex-economic adviser Dr Salman Shah, MCB President/CEO Atif Bajwa, Dr Nadeemul Haq, NIB President/CEO Khawaja Iqbal Hassan, Tariq Sayeed Saigol, Tariq Mahmood and chairman APTMA also spoke at the seminar. Earlier, Editor The Nation Arif Nizami delivered the welcoming address.

Tuesday, April 16, 2024

No raise in Sales Tax: Tarin

Stock market today: Most of Wall Street weakens again as Treasury yields rise more

10:34 PM | April 16, 2024

Muslim K-popstar Daud Kim buys land to build mosque in South Korea

10:33 PM | April 16, 2024

Punjab Stadium unavailability derails National Challenge Cup 2023 Final Round

10:28 PM | April 16, 2024

Death anniversary of comedian Babu Baral being observed today

10:12 PM | April 16, 2024

Heavy rains lash UAE and surrounding nations as the death toll in Oman flooding rises to 18

10:11 PM | April 16, 2024

Political Reconciliation

April 16, 2024

Pricing Pressures

April 16, 2024

Western Hypocrisy

April 16, 2024

Policing Reforms

April 15, 2024

Storm Safety

April 15, 2024

Democratic harmony

April 16, 2024

Digital dilemma

April 16, 2024

Classroom crisis

April 16, 2024

Bridging gaps

April 16, 2024

Suicide awareness

April 15, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024