KARACHI -

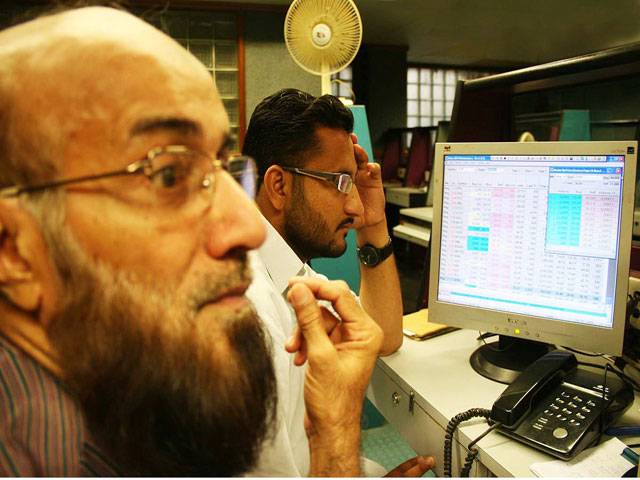

Global sell-off, security unrest in Karachi, limited foreign interest and economic uncertainty hit the stock market on Friday as the benchmark KSE 100-index fell by more than 1 per cent.

The benchmark KSE 100-share index shed 316.69 points or 1.44 per cent to end the day at 21698.35 points after opening at 22015.04 points.

Index heavy weight OGDC, MCB and PSO came down sharply, while some interest was witnessed in cement stocks on the back of decline in coal prices and likely reduction in policy rate. News flow that gas subsidy on fertilizer will be withdrawn affected fertilizer stocks, dealer observed.

KSE allshare-index shed 196.06 points or 1.26 per cent to close the day at 15339.99 points, KSE 30-share index decreased by 257.69 points or 1.51 per cent to close the day at 16838.19 points while KMI 30-share index lost 546.70 points or 1.45 per cent to conclude the session at 37203.32 points.

Ahsan Mehanti said investors remained cautious ahead of SBP policy announcement. Security unrest in the city after killing of provincial minister affected the sentiments despite recovery witnessed in second session. Limited foreign interest and economic uncertainty played a catalyst role in bearish sentiments at KSE. The turnover of stock market in terms of shares was 276.686 million shares after opening at 302.131 million shares and the value of traded shares climbed to Rs 9.647 billion from Rs 9.542 billion. The capitalization of equity market maintained at Rs 5.275 trillion as compared to Rs 5.344 trillion of a day earlier.

Shares of 350 companies were traded on Friday where 66 closed in positive and 263 in negative while the values of 21 stocks remained intact. Unilever Food was the top price gainer of the day, up by Rs 105 to Rs 4770, followed by Exide (Pak), gained Rs 21.70 to Rs 458.77. Colgate Palmolive and Dreamworld were the biggest losers of the day, decreased by Rs 93 to Rs 1800 and Rs 13.55 to Rs 257.50.

Fauji Cement was the volume leader of the day with 35.578 million shares as it closed at Rs 13.53 after opening at Rs 13.13. It was followed by TRG Pakistan Limited with 35.257 million shares, shed Rs 1.02 to Rs 10.28, JS Company with 12.254 million shares, decreased by Rs 0.75 to Rs 12.86, WorldCall Telecom with 11.205 million shares, down by Re 0.12 to Rs 2.99, and Maple Leaf Cement with 11.141 million shares, shed Re 0.22 to Rs 23.58.

In weekly review, equity dealer at Topline Securities Samar Iqbal said global selling in equity markets and confusion over next two months monetary policy stance forced market to decline by 4% on week on week basis. Volume in rupee terms also declined by 13% to Rs.9b. On the other hand, decline in coal prices and increase in cement bag prices kept investors interest alive in cement stocks. However, news flow of withdrawal of gas subsidy for fertilizer plants affected fertilizer stocks. During the week, visit of IMF generated indications that Pakistan may get new loan that will help to overcome balance of payment problems. Going forward, after 50bps cut in policy rate renewed interest would be seen in leveraged companies. IMF related developments and budget approval would be the key highlights of the coming week.

Sunday, May 19, 2024

Global sell-off, security unrest shave 316 points off 100-index

PPP rejects in-house change proposal in Azad Kashmir

2:58 PM | May 19, 2024

PM directs to make arrangements to bring back Pakistani students from Kyrgyzstan

2:10 PM | May 19, 2024

Ishaq Dar’s Kyrgyzstan visit ‘cancelled’

12:59 PM | May 19, 2024

SIFC’s project Green Tourism revolutionizing tourism sector in GB

12:42 PM | May 19, 2024

Punjab CM, Japanese envoy discuss ways to strengthen bilateral trade & investment

12:35 PM | May 19, 2024

NEPRA’s Neglect

May 19, 2024

Colonial Grip

May 19, 2024

Confrontational Politics

May 19, 2024

Sports & Genocide

May 18, 2024

Healing AJK

May 18, 2024

Unsung Heroes of Society

May 19, 2024

Water Shortage in Our Area

May 19, 2024

The AI Trap

May 19, 2024

Continuing Narrative of Nakba

May 18, 2024

Teacher Struggles

May 18, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024