LAHORE - The speakers at ‘1st World Islamic Economics & Finance Conference’ observed that Islamic banking is growing globally, as its annual growth rate is 15 to 20 percent and its volume has crossed the level of one trillion US dollars.

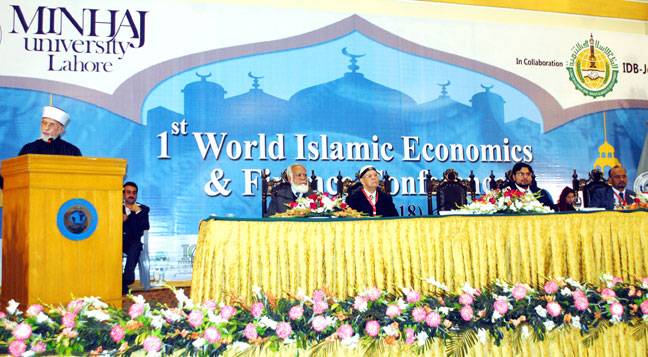

The conference was attended by known economists from UAE, Australia, UK, America, Saudi Arabia, Indonesia, Malaysia etc. The conference was organised by Minhaj University Lahore in collaboration with Islamic Development Bank, Jeddah & Islamic Research, and Training Institute. On the first day different sessions were arranged.

Besides Dr Tahir Ul Qadri, Prof Dr Masood ul Alam Ch, Prof Ishaq Bhatti, Vice chancellor Dr Aslam Ghouri and International Scholars from different universities presented their research papers.

The 1st World Islamic Economics Conference (WIEFC 2018) was aimed at bringing together leading International and local academicians, scientists and researchers of Islamic Economics and Finance to exchange and share their experiences and research results on all aspects of Islamic Economics & Finance. It also provided a premier interdisciplinary platform for researchers, practitioners and educators to present and discuss the recent development and innovations, trends, and concerns as well as practical challenges encountered and solutions adopted in the fields of islamic banking, economics, and finance industry around the world.

The speakers said that WIEFC 2018 was also aimed at enabling Islamic Finance to converge and grow itself as an economic system whilst equipping leaders with breakthrough insights to navigate the complexity of the global financial system.

Head of Pakistan Awami Tehrik Dr. Tahir Ul Qadri, addressing the opening session of 2 days Conference, said Pakistan is one of those countries where Islamic banking is constantly growing. Its growth rate can boostt further if different obstacles that Islamic banking sector is facing are removed including differences among different Islamic Schools of Thoughts.

“Islamic Banking has potential to play active central role in international financial system, but various local laws and explanations of different Islamic Schools of thoughts are standing in its way which needs to be removed, so Islamic Banking Sector could meet requirements of whole world and extend its role in global economy. Differences among Islamic Schools about banking and their discriminatory application must be replaced with universally acknowledged code which would ensure lasting development.”

Dr Tahir Ul Qadri sid that Muslim world needs to form her economic identity on the basis of sound and stable economic foundations. He said Islamic Banking sector is currently under influence of different schools of thought; different Fatwa councils make their rules, regulate and enforce them. Regional Banks follow their own schools of thoughts accordingly. At times rules set by one school of thought may not be acceptable for another country or region. This situation of major hitch in the growth of Islamic banking globally hence must be removed.

“Islamic scholars, bankers and economists should join hand to eradicate these obstacles by formulating uniform rules applicable internationally.” He said Islamic Banking can play leading role in interest-free banking; to achieve these goal Islamic scholars would have to understand the needs and requirements of contemporary world. He said to ensure growth of Islamic Banking sector we need the rule of “coping others”, instead of negating others; and this can be achieved by forming “Global Sharia Finance Guidance Authority” represented by scholars of all Schools of thought, wherein none of the scholar would power to veto any banking product. He said if school of thought allows one Banking service, other rejects; to overcome this phenomenon we would have to entrust powers to “Global Sharia Finance Guidance Authority”, to get rid of finitude, we have to follow the rule of “coping others”. He said rules formulated by “Global Sharia Finance Guidance Authority” would be applicable in all Islamic Banks at regional as well as international level, thus eradicating monopoly of a single school of thought in any region.