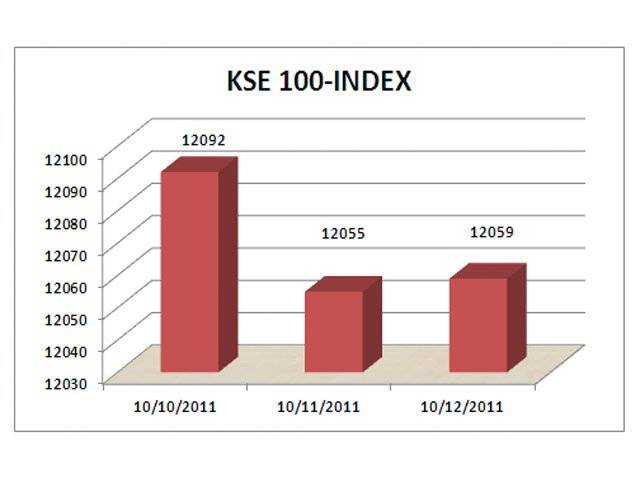

KARACHI (Reuters) The Karachi stock market closed almost flat on Wednesday as investors sold shares at higher levels but bargain hunters accumulated fertiliser shares following an increase in urea prices, dealers said. The KSE benchmark 100-share index ended 0.04 percent, or 4.25 points, higher at 12,059.07. Volume was 117.8 million shares, compared with 141.7 million shares traded on Tuesday. "There was some buying in the fertiliser sector following a rise in urea prices which would increase their earnings," said Ahsan Mehanti, director at Arif Habib Investments Ltd. Fauji Bin Qasim ended 2.28 percent higher at 62.68 rupees and Fauji Fertiliser closed up 2.53 percent at 184.90 rupees. In the currency market, the rupee firmed to 87.15/20 to the dollar compared with Tuesday's close of 87.36/41 on increased remittances from Pakistanis living abroad. According to official data, remittances rose 25 percent to $3.3 billion in the first three months of 2010/11 fiscal year (July-June), compared with $2.65 billion in the same period last year. However remittances fell to $890 million in September, compared with $922 million received in September last year. APP adds from Islamabad: Islamabad Stock Exchange (ISE-10) on Wednesday witnessed bearish trend as the index closed at 2640.64 after losing 7.76 points. Senior Analyst, Association for Investors' Awareness, Fahim Akhtar told APP that the local markets were seen as dull, lacklustre and directionless with picking of attractive stock with good yield during Wednesday session. The role and participation of Foreign Investors Portfolio Investment (FIPI) and funds will remain significant particularly fertilizer stocks appreciating with the price hike in market price of product by leading companies and anticipation of analyst for affected earning of banks with lower interest rate. Equity Dealer, Ismail Iqbal Pvt Ltd, Jeewan said that market also sought some catalyst for upward movement with existing good valuations in many blue chips and asked cautious investment plan implementation taking into account to wait and watch on political relationship front. He added hat MCB is oversold and getting into attractive level for long term investment for high capital gains. Total shares traded were 116,199, which was down by 220,386 against trading of a day earlier. Out of 125 companies, the price of 60 increased while the price of 64 decreased and price of one remained unchanged. The price of top gainer Bhanero Texile increased by Rs.12.21 while the price top loser Siemen Engineering decreased by Rs.25.81.

Friday, April 26, 2024

KSE remains flat with some buying in fertiliser sector

PM approves in principle reforms in power sector

April 26, 2024

Pak-Iran gasline project to be completed: Kh Asif

April 26, 2024

Pakistan rejects US report on HR practices

April 26, 2024

No room for criminals in Punjab: CM Maryam

April 26, 2024

PTI’s talks with terrorists hindered NAP execution: Tarar

April 26, 2024

Economic Challenges

April 26, 2024

No Compromise

April 26, 2024

Strength and Solidarity

April 26, 2024

Musk vs Australia

April 25, 2024

Reforming Rehab

April 25, 2024

Photon power

April 26, 2024

Justice prevails

April 26, 2024

Ending animal suffering

April 25, 2024

AI governance

April 25, 2024

AI concerns

April 25, 2024

ePaper - Nawaiwaqt

Advertisement

Nawaiwaqt Group | Copyright © 2024