The failure of contemporary economics to alleviate the current economic turmoil holding the global economy down has condemned the existing theories for their inherent flaws. The existing knowledge on the subject has failed miserably to tackle the issues facing the world economy particularly European countries mired with huge public debt. As I argued in one of my previous blogs, Pakistan is failing to learn a lesson from the ongoing crises in Europe & the Nawaz-led government’s debt acquisition has soared to an all-time high as it crossed the Rs2.2 trillion mark. Based on the newly released figures by State Bank of Pakistan (SBP), debt in last three years has surged by Rs0.8 trillion.

In the Middle East, Kingdom of Saudi Arabia (KSA) is another victim of the brutal repercussions of Capitalism as subdued demand in the global economy has hit its margins hard & it has failed to bounce back because of the lack of diversity in its economy has exposed the bitter reality of not doing enough, when going was good . It has forced once a kingpin in Gulf to follow the familiar route and borrow. KSA has eclipsed Argentina’s $16.5 billion offering & had raised $17.5 billion in the record Sovereign Bond Sale. But, this is a merely a start & in the future Saudi is expected to borrow more and face more financial tests as the country’s woes deepen.

Over the years, economists felt proud of having brought in sophisticated mathematical modeling to predict the future with certainty or at least provide some insight into expected events, but academics around the world appear bamboozled & somewhat embarrassed upon their failure to predict or deal with economic crises. Academics like Paul Romer and Paul Krugman whose textbooks are a regular feature in advanced macroeconomic classes around the world and in Pakistan have argued that it’s time to say goodbye to flawed and incomplete economic models which have failed to understand the reality of human behavior. Romer’s latest article which has made huge waves around the globe has labeled macroeconomics as a science which has turned the field backwards as it has threatened the world markets rather than facilitating them as it played with imaginary disruptions. Another world class economist, Oliver Blanchard questioned the implications of the vastly used (Dynamic Stochastic General Equilibrium) DSGE models & also labeled them as seriously flawed, though improvable, labeling them as crucial to the future of macroeconomics.

With traditional economics & capitalism at a crossroads, it clearly signals that despite a dramatic rise in living standards around the world & progress experienced by mankind, the current system is fragile & prone to unbearable shocks. The present system enslaves nations through debt which threatens the employment levels and output in the respective countries. With KSA going the same way with bond issues and lying on the verge of bankruptcy, unless some drastic steps are taken, & countries like Pakistan & Egypt with an ever increasing public debt must reawaken and rekindle their quest for the implementation of the Islamic Economic System.

Islamic dogma presents a simple yet most convincing & rational way to run the affairs of a nation. Though the Islamic system is a hybrid of both capitalism and socialism, but choices & behavior are restricted within the guidelines & postulates. It limits the individuals, societies and governments to act only in a way permissible under the Shariah. The most important aspect of Islamic economics is the prohibition of Riba and speculations in the transactions (any transaction or contract which is uncertain is null and void in Islam). Since these manmade systems are deprived of any religious involvement, resultantly, they shun morality, ethics and embrace human intellect.

The existing systems only favor the capitalists and have been extremely unfair towards society. The political elite which comes into power with the help of wealthy investors and lobbyists, ends up legislating to benefit their sponsors at the cost of society. Muslim countries have largely embraced capitalism and out favored the Islamic doctrine. Pakistani governments continue to follow traditional economic policies and have witnessed terrible consequences for not alienating from an interest-based financial system as debt continues to soar, making it bow to the commands of the Western masters. The common logic given for the practice is that we have to work through in a universal system which follows the interest-based system, resultantly, the lack of an alternative system is pushing Pakistan to the brink.

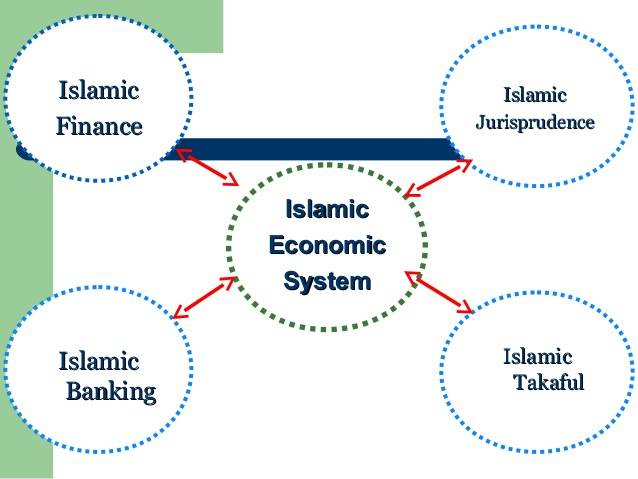

The emergence of Islamic banking and its success is paving the way forward for Muslim consumers willing to follow the Islamic doctrine & it should set a precedent for the government that given the right prognostications, abolishing the conventional interest-based system is not mission impossible.

The traditional system alienates itself from traditional science using the arguments that it cannot be applied universally across the globe as economic realities are distinct in different parts of the world. But, the Islamic economic system is applicable across the globe as its dogma is universal and provides the same regulative framework for all. The market mechanism in Islam approved by Prophet (PBUH) requires voluntary and involuntary organizations which ensure the social security, solidarity mechanism for the wastage problem, over-utilizations & excessive exploitation of natural resources, distributive justice through risk sharing and stake-taking, equity-based, and interest free economic systems.

If Pakistan is to avert the crises, it must establish Islamic economic research centers, equip them with state-of-the-art facilities and learn to rely on its own resources & slowly alienate the existing financial system which is too fragile and toxic for the society. The human intellect contradicts itself very often but Allah’s revelations are forever and binding on human beings. Muslim countries which continue to refrain from embracing Islamic economics must realize that it is nothing but the sign of unbelief and fraud. As the great Iqbal Said,

Where lies the grandeur of a king

Whose riches rest on borrowed gold?

You put your faith in idols vain

And turn your back on Mighty God

If this is not unbelief and sin

What is unbelief and fraud?